The Buzz on Bitcoin and crypto prices are volatile— what to do when they

Our 3 Short-Term Cryptocurrency Investing Time Frames - dummies PDFs

Hardly ever, it can be formed as a trend turnaround pattern at the end of an upward trend. Reference of where they take place, the pattern shows bearishness. This pattern is formed after a long downward trend and indicates trend reversal. The in proportion triangle pattern is comprised of an unique shape created by convergence of 2 pattern lines.

The pattern is also described as a "", indicating a long-term (last in between numerous months and years) bullish reversal. By discovering to determine a cost pattern, a trader will be able to leave a Bitcoin trade with no predicament. Exit based on harmonic patterns Harmonic cost patterns are a better method of determining trend turnarounds by using Fibonacci ratios to geometric cost patterns.

Determined from the Fibonacci number series: 0. 618 = Main Ratio1. 618 = Main Forecast 0. 786 = Square root of 0. 6180.886 = 4th roofing system of 0. 618 or Square root of 0. 7861.130 = Fourth root of 1. 618 or Square root of 1. 271.270 = Square root of 1.

382 = (1 0. 618) or 0. 618e20.500 = 0. 770e20.707 = Square root of 0. 501.410 = Square root of 2. 02.000 = 1 + 12. 240 = Square root of 52. 618 = 1. 618e23.141 = Pi3. 618 = 1 + 2. 618 Exit based on distinct cost history For a variety of factors, Bitcoin tends to stay in a downtrend or uptrend on particular months of a year.

Bitcoin Mining Machine Youtube When Is The Best Time To Sell Things To Know Before You Get This

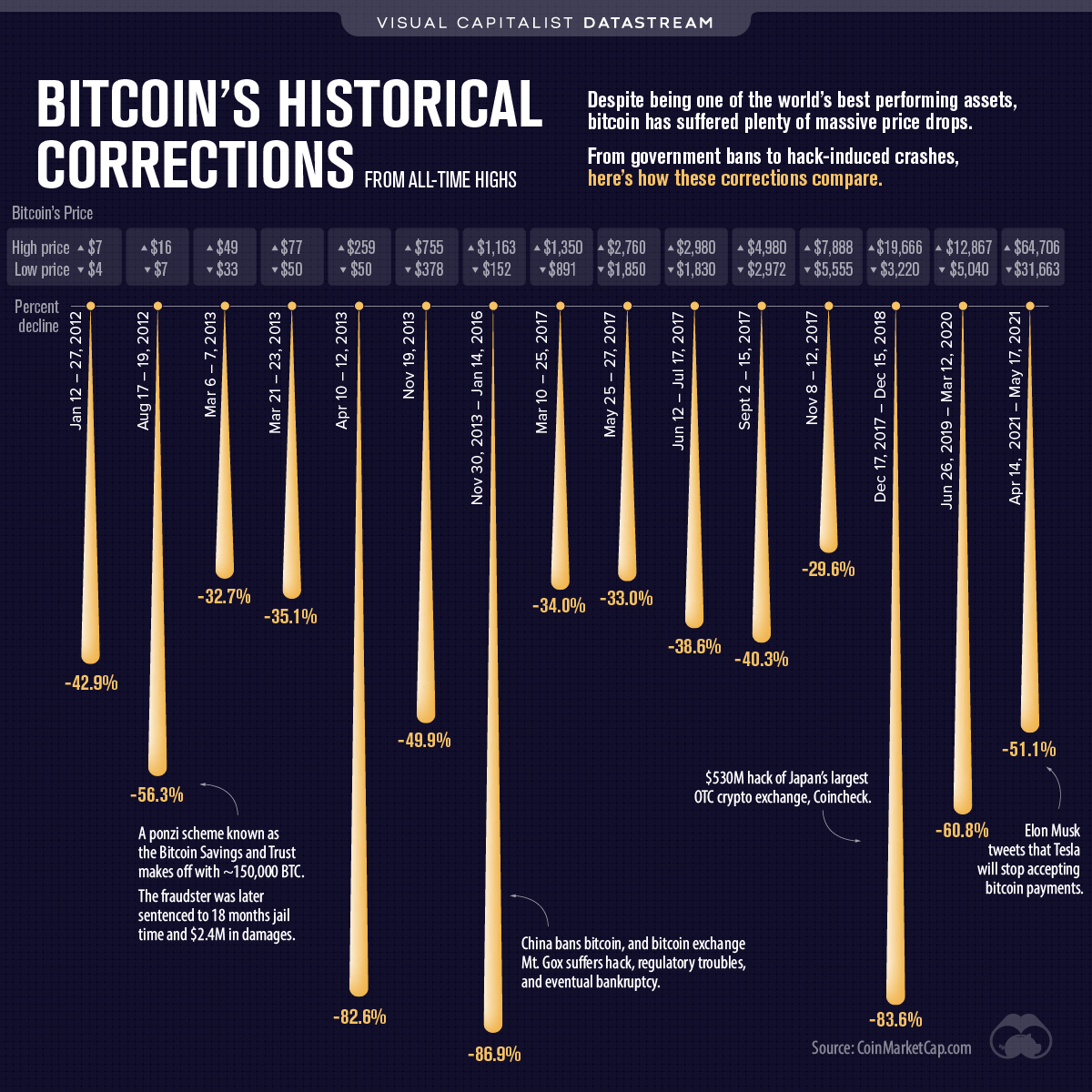

For the previous numerous years, Bitcoin either trades flat or falls dramatically in January of every year. In 2015 and 2016, the crypto lost 12. 7% and 27. 3%, respectively. In 2018, nevertheless, Bitcoin traded nearly flat (+0. 51% gain). Using a stand out sheet, a trader can identify such attributes and utilize it for offering at the correct time.

UNDER MAINTENANCE