"Understanding Osprey Bitcoin Trust: A Comprehensive Guide" Can Be Fun For Everyone

Investing in digital currencies has come to be considerably prominent over the previous handful of years. One such electronic money is Bitcoin, which has observed a rise in passion and investment. Osprey Bitcoin Trust is an financial investment depend on that offers real estate investors visibility to Bitcoin. In this write-up, we are going to discuss the pros and downsides of investing in Osprey Bitcoin Trust.

Pros:

1. Visibility to Bitcoin: Investing in Osprey Bitcoin Trust gives clients along with direct exposure to Bitcoin without having to purchase and keep the cryptocurrency themselves. This can easily be particularly pleasing for capitalists who are brand-new to the world of cryptocurrencies or who are afraid to invest straight in them.

2. Beneficial: Investing in Osprey Bitcoin Trust is relatively effortless and practical compared to acquiring and keeping bodily Bitcoins. Capitalists can acquire portions of the trust with their stock broker profile, simply like they would with any sort of other stock or exchange-traded fund (ETF).

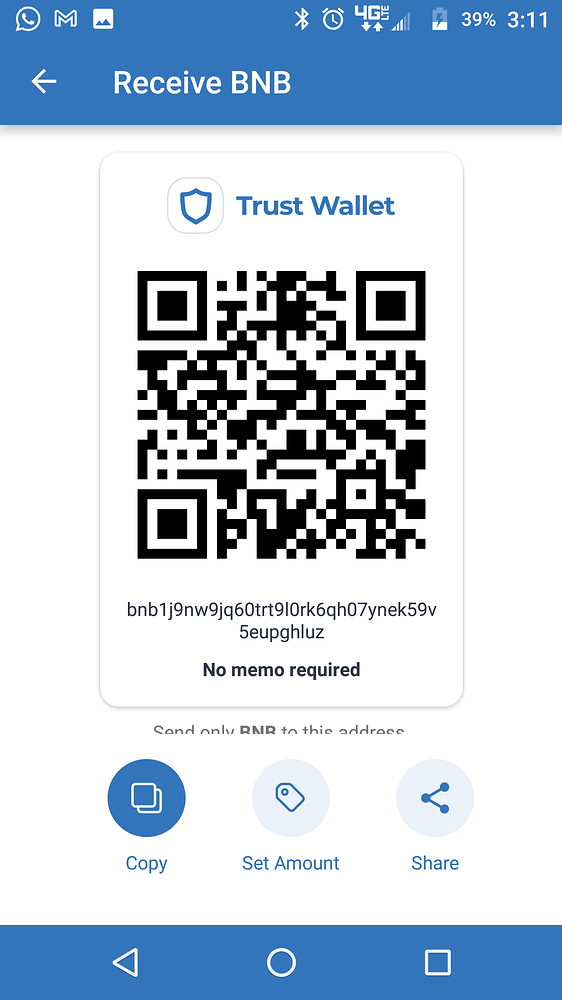

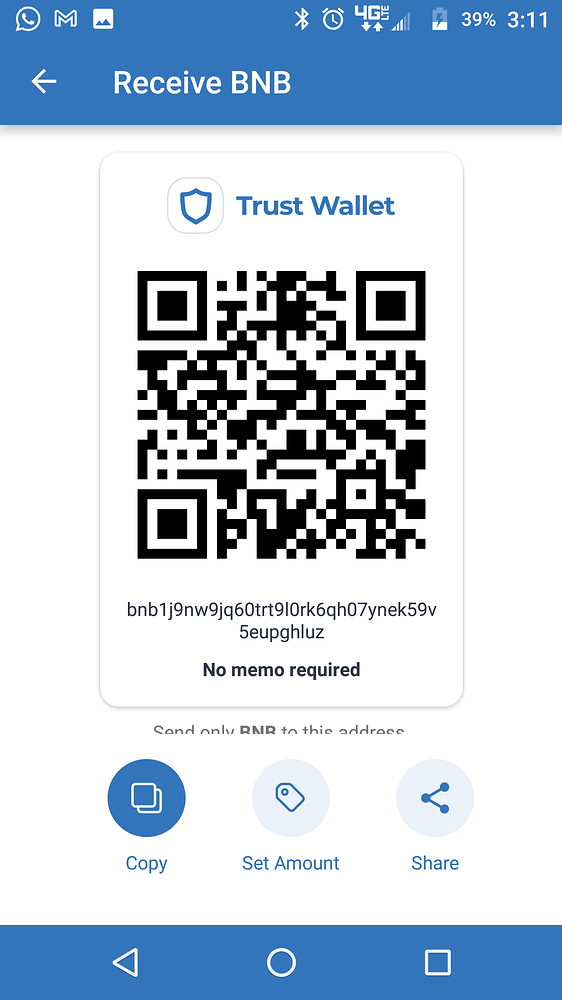

3. how to convert bitcoin to bnb in trust wallet : Unlike lots of other cryptocurrency investments, Osprey Bitcoin Trust is regulated by the U.S Securities and Exchange Commission (SEC). This incorporates a coating of defense for capitalists as it guarantees that the count on follows certain guidelines and regulations.

4. Low Fees: The fees linked with putting in in Osprey Bitcoin Trust are fairly reduced contrasted to other cryptocurrency expenditures. The annual expenditure proportion for the rely on is 0.49%, which is significantly reduced than what many proactively managed funds fee.

Drawbacks:

1. Volatility: Like all cryptocurrencies, Bitcoin can be extremely unstable, which indicates that there is a threat of losing funds when committing in Osprey Bitcoin Trust.

2. Minimal Exposure: While investing in Osprey Bitcoin Trust does provide direct exposure to Bitcoin, it does not provide direct exposure to other cryptocurrencies or blockchain innovations.

3. Lack of Control: When investing in a trust like Osprey Bitcoin Trust, real estate investors do not have management over how their funds are spent or managed.

4. Governing Threat: While being regulated by the SEC is a positive for Osprey Bitcoin Trust, there is actually consistently the risk that requirements could alter in the future, which can impact the trust's functions and efficiency.

Final thought:

Committing in Osprey Bitcoin Trust can easily be an appealing option for entrepreneurs who are fascinated in getting exposure to Bitcoin but are unsure to spend straight in cryptocurrencies. However, like all financial investments, there are pros and disadvantages to consider before investing. The dryness of Bitcoin and shortage of command over how funds are handled are potential downsides, while the ease, low expenses, and regulation through the SEC are possible benefits. Essentially, capitalists require to very carefully take into consideration their own expenditure objectives and risk tolerance prior to deciding whether or not to put in in Osprey Bitcoin Trust.

Pros:

1. Visibility to Bitcoin: Investing in Osprey Bitcoin Trust gives clients along with direct exposure to Bitcoin without having to purchase and keep the cryptocurrency themselves. This can easily be particularly pleasing for capitalists who are brand-new to the world of cryptocurrencies or who are afraid to invest straight in them.

2. Beneficial: Investing in Osprey Bitcoin Trust is relatively effortless and practical compared to acquiring and keeping bodily Bitcoins. Capitalists can acquire portions of the trust with their stock broker profile, simply like they would with any sort of other stock or exchange-traded fund (ETF).

3. how to convert bitcoin to bnb in trust wallet : Unlike lots of other cryptocurrency investments, Osprey Bitcoin Trust is regulated by the U.S Securities and Exchange Commission (SEC). This incorporates a coating of defense for capitalists as it guarantees that the count on follows certain guidelines and regulations.

4. Low Fees: The fees linked with putting in in Osprey Bitcoin Trust are fairly reduced contrasted to other cryptocurrency expenditures. The annual expenditure proportion for the rely on is 0.49%, which is significantly reduced than what many proactively managed funds fee.

Drawbacks:

1. Volatility: Like all cryptocurrencies, Bitcoin can be extremely unstable, which indicates that there is a threat of losing funds when committing in Osprey Bitcoin Trust.

2. Minimal Exposure: While investing in Osprey Bitcoin Trust does provide direct exposure to Bitcoin, it does not provide direct exposure to other cryptocurrencies or blockchain innovations.

3. Lack of Control: When investing in a trust like Osprey Bitcoin Trust, real estate investors do not have management over how their funds are spent or managed.

4. Governing Threat: While being regulated by the SEC is a positive for Osprey Bitcoin Trust, there is actually consistently the risk that requirements could alter in the future, which can impact the trust's functions and efficiency.

Final thought:

Committing in Osprey Bitcoin Trust can easily be an appealing option for entrepreneurs who are fascinated in getting exposure to Bitcoin but are unsure to spend straight in cryptocurrencies. However, like all financial investments, there are pros and disadvantages to consider before investing. The dryness of Bitcoin and shortage of command over how funds are handled are potential downsides, while the ease, low expenses, and regulation through the SEC are possible benefits. Essentially, capitalists require to very carefully take into consideration their own expenditure objectives and risk tolerance prior to deciding whether or not to put in in Osprey Bitcoin Trust.

Created at 2023-05-17 20:15

Back to posts

This post has no comments - be the first one!

UNDER MAINTENANCE